"All In One" Programs

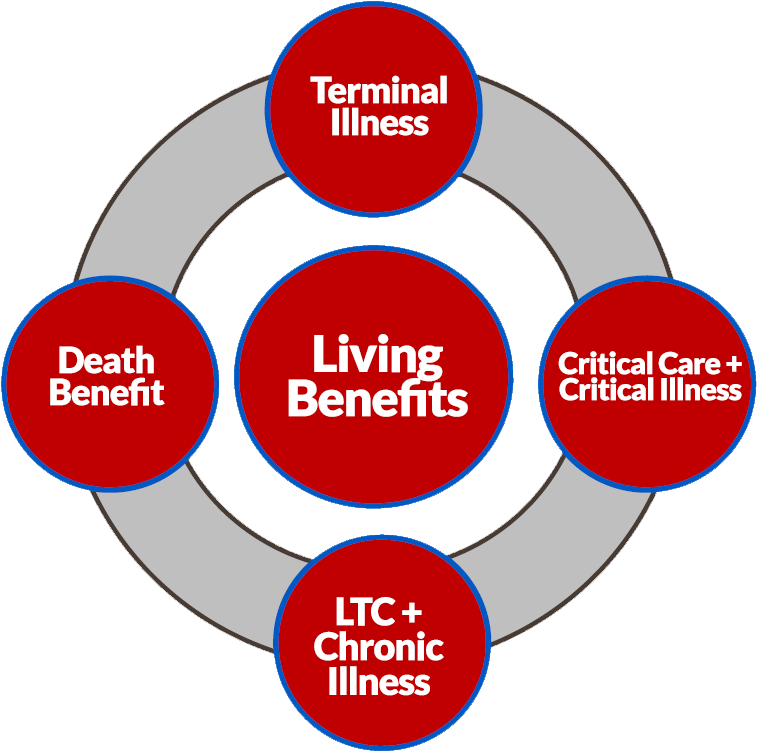

EXAMPLE: Comprehensive Group Term or Group Universal Life Insurance + Living Benefits

Comprehensive benefit plans that assists individuals and their families by providing the security of being prepared to survive the financial challenges often created by a serious illness or accident.

SOLUTIONS FOR FINANCIAL SECURITY

Group Renewable Term Benefit Features

Long Term Care

- Benefit dollars are paid to the insured in cash

- No receipts required to receive benefits

- No licensed caregiver required to provide services

- Pays 4% of face amount per month up to 25 months for Facility Care

- Pays 2% of face amount per month up to 50 months for Home Care

- Requires a doctor’s certification that a chronic condition is permanent andrequires assistance performing two ADL’S or Substantial Supervision due to Cognitive Impairment, Eating, Bathing, Dressing, Toileting, Transferring (walking) and Continence

- 90 day elimination period

Extension of Benefits for Long Term Care

- Benefits are paid up to an additional 25 months for Facility Care

- Benefits are paid up to an additional 50 months for Home Care

- After all Living Benefits are exhausted, your beneficiary will receive 25% of the death benefit

Critical Care Condition

- Provides up to 25% of your death benefit to pay for costs associated with cancer, stroke, heart attack, kidney failure or major organ transplant surgery.

Terminal Illness

- Lets the insured "tap into" 50% of the Death Benefit in the event of a future terminal illness diagnosis and still provides a benefit for the beneficiary.

Underwriting

COVERAGE LIMITS

- Issue Ages

- Employees/Directors 16‐65

- Spouses 16‐65

- Children /Grandchildren 15 days ‐ 25

- Employee and Director Coverage:

- Conditional Guaranteed Issue → $100,000

- Simplified Issue → $500,000

- Spouse Coverage:

- Conditional Guaranteed Issue → $25,000

- Simplified Issue → $100,000

HEALTH QUESTIONS

- In the past six months, has any proposed insured been hospitalized (inpatient or outpatient) or missed more than five consecutive days of work due to any accident or sickness, except for normal pregnancy?

- In the past five years, has any proposed insured had an actual diagnosis or treatment by a member of the medical profession for Acquired Immune Deficiency Syndrome (AIDS) or AIDS Related Complex (ARC)?

Group Universal Life Insurance Benefit Features

Living Benefit/Chronic Condition

- Benefit dollars are paid to the insured in cash

- No receipts required to receive benefits

- No licensed caregiver required to provide services

- Pays 4% of face amount per month up to 25 months for Facility Care or Home Care

- Requires a doctor’s certification that a chronic condition is permanent and requires assistance performing two ADL’S or Substantial Supervision due to Cognitive Impairment, Eating, Bathing, Dressing, Toileting, Transferring (walking) and Continence

- 90 day elimination period

Extension of Benefits for Chronic Condition

- Benefits are paid up to an additional 25 months

- After all Living Benefits are exhausted, your beneficiary will receive 25% of the death benefit

Critical Condition

- Provides up to 25% of your death benefit to pay for costs associated with cancer, stroke, heart attack, kidney failure or organ transplant.

Terminal Illness

- Lets the insured "tap into" 75% of the Death Benefit in the event of a future terminal illness diagnosis and still provides a benefit for the beneficiary.

Underwriting

COVERAGE LIMITS

- Issue Ages

- Employees/Directors 16‐80

- Spouses 16‐65

- Children /Grandchildren 15 days ‐ 24

- Employee and Director Coverage:

- Conditional Guaranteed Issue → $100,000

- Simplified Issue → $500,000

- Spouse Coverage:

- Conditional Guaranteed Issue → $25,000

- Simplified Issue → $100,000

HEALTH QUESTIONS

- In the past six months, has any proposed insured been hospitalized (inpatient or outpatient) or missed more than five consecutive days of work due to any accident or sickness, except for normal pregnancy?

- In the past five years, has any proposed insured had an actual diagnosis or treatment by a member of the medical profession for Acquired Immune Deficiency Syndrome (AIDS) or AIDS Related Complex (ARC)?